Aurora Casilli lost her savings $36,561 in a National Australia Bank (NAB) Phone Scam

Aurora Casilli from Australia claims to have been scammed out of $36,561 in a matter of seconds brought shocking news in the community. After scoring her first job at 14, Aurora Casilli has been dreaming of the day she would have enough money to buy her very own home.

The 18-year-old from Albany, Western Australia, says she has always known the value of money and over the years, had meticulously saved every cent she possibly could. At one stage, she was even working three different jobs to help fatten her savings account.

But now Aurora says all her years of dedication and hard work were wasted, as she now “has nothing to her name” after falling victim to an alleged phone scam.

Aurora received an alarming text message that she believed was from her bank (NAB), which stated someone with a name she did not recognize was attempting to make a transfer from her account.

The message appeared to be from National Australian Bank (NAB), as it was from the same number and in the same text message thread as previous, legitimate communications from the bank.

This technique is known as spoofing and is commonly used by scammers to appear more legitimate to potential victims.

The text urged her to call their 1800 number if she had not authorized the payment, which the teenager decided to dial as she was in a “state of panic”.

“I was just at home, about to make breakfast when the text came through,” she recalled.

“I panicked when I read it. All the money I had saved, and now I thought someone was in my account trying to make an unauthorized transfer.

“The text was from NAB, [National Australia Bank] and was underneath others messages I got from them. It seemed legit to me, so I called the number in a panic.

“If it was from a random mobile number, I wouldn’t have believed it. But it seemed so real.”

Aurora explained that at the time, nothing seemed “off”.

The text appeared to be from NAB, and when she dialed the phone number for help, she claims the music and voice prompts were identical to when she called her bank in the past. She even waited an hour on hold to talk to someone, which she says only added to the perceived legitimacy of the call.

Aurora was then greeted by what she describes as a “professional and polite” man with a British accent, who explained to her that someone had gained access to her bank account.

“He sounded like any normal person working at a bank,” she explained.

“You hear things on the news about scammers being from other countries and having broken English or heavy foreign accents.

“But he was just a man with a British accent that spoke in a professional way. It did not seem suspicious.”

For her financial security, she was told to transfer the entirety of her savings into another NAB account in her name, which the man was supposedly setting up for her on the phone.

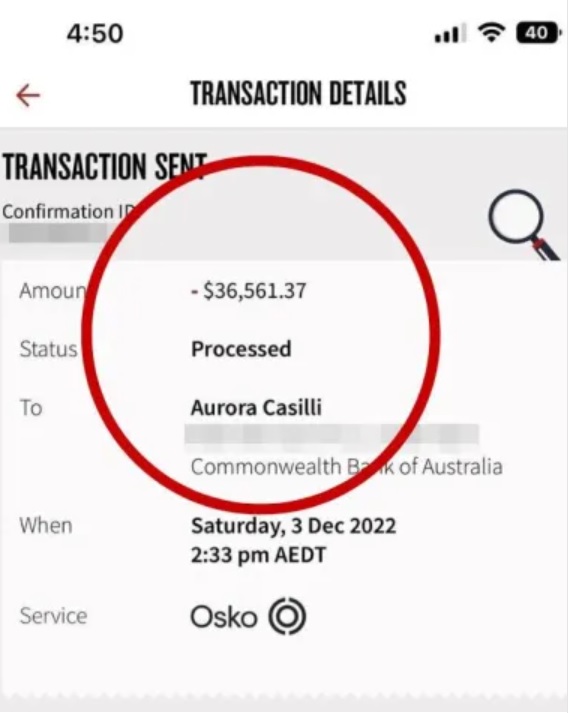

Aurora believed him, and quickly sent over $25,158.88 – her entire life savings. Seconds after confirming the transfer, the man hung up.

After looking up the BSB, she realized that the account she transferred her savings into was actually a Commonwealth Bank account, not NAB.

“I felt sick, I just got this gut feeling that something was terribly wrong,” she said.

“I called back, and asked why he wanted me to transfer the money into a Commonwealth account. He hung up again.

“That’s when it hit home, I’d been scammed.”

The BSB [location code] of the Commonwealth Bank account that she had transferred the funds into is linked to a branch in Perth, Australia.

Aurora says she contacted Commonwealth to try and stop the transfer, however it was too late – the funds had already been taken out.

She says they are looking into the case and told her that they have “flagged” the account.

Aurora says she now has no money to her name but is thankful for her boyfriend Matthew, 21, who is covering both their living expenses in their shared household.

“I was on the phone for hours trying to get through to CBA,” she said.

“It was so stressful, and then I’m told there is basically nothing that they could do.

“Once the funds are taken out, it is too late. I have no idea what happened to my money or what they are doing with it.”

Aurora reached out to NAB for help following the incident.

The bank looked into what had occurred and reached a formal decision on the matter on January 3.

In a letter NAB determined that bank is not liable for the lost of funds, due to the payment being authorized by Aurora.

NAB did not consider Aurora to be a victim of a scam, as the payments were made with her normal device and there was nothing to suggest that this occurred due to a failure of the bank.

“If it can happen to me, it could happen to anyone. It is so scary what these scammers can do. Said Aurora